Top 10 LSAW Steel Pipe Manufacturers in 2026 (2025 Review)

Introduction: Why LSAW steel pipes play an important role in global infrastructure (2026)

LSAW (Longitudinal Submerged Arc Welded) steel pipes play a pivotal role in global energy and infrastructure development, serving as the backbone for oil and gas transmission, water supply systems, and large-scale construction projects. As we enter 2026, the global infrastructure industry is experiencing a major recovery and expansion, driven by the increase in energy demands and the modernization of government investments channels. Driven by the increasing energy demand and infrastructure upgrading of emerging economies, the market of longitudinal submerged arc welded pipe is expected to grow by 2.3% CAGR by 2026.

The unique manufacturing process of LSAW pipes—using longitudinal submerged arc welding on thick steel plates—makes them ideal for high-pressure applications and large-diameter requirements. Compared to SSAW (spiral submerged arc welded) and ERW (electric resistance welded) pipes, LSAW pipes offer superior strength, better dimensional accuracy, and enhanced pressure-bearing capacity, making them the preferred choice for critical infrastructure projects where safety and reliability are paramount.

What is an LSAW steel pipe?

Definition and manufacturing methods

LSAW steel pipe is manufactured by longitudinal submerged arc welding process, in which steel plates is cold-formed into a cylinder by JCOE or UOE forming processes before double-sided submerged arc welding. This method ensures excellent welding quality and dimensional accuracy. Compared with spiral welding, longitudinal welding provides better strength characteristics.

Typical size range and standard

LSAW pipes is characterized by its large diameter capacity, usually ranging from 406 mm to 1620 mm (16 inches to 64 inches), wall thicknesses ranging from 6 mm to 60 mm, and lengths up to 18 meters. These pipelines conform to major international standards, including API 5L PSL 1/PSL 2, ASTM A 252, ASTM A 671/a 672, EN 10219 and EN 10217, which ensure global compatibility and quality assurance.

Main Applications programs

LSAW steel pipes are mainly used in:

- Oil and gas pipelines (long distance and high pressure applications)

- Water supply and sewerage systems.

- Structural applications of buildings and infrastructure.

- Offshore engineering and ocean engineering.

- Power stations and industrial piping systems.

Overview of global LSAW market (review in 2025 → prospect in 2026)

Demand tendency

The LSAW Pipe market experienced steady growth in 2025, driven by several key factors. The oil and gas industry is still the biggest consumer, accounting for about 90% of new pipeline construction using longitudinal welding technology. Emerging economies such as India and China continue to invest heavily in expanding the oil and gas pipeline networks to ensure the stability of domestic energy supply. Additionally, water infrastructure upgrades—with nearly 50% of U.S. water utilities planning pipeline replacements within the next decade—are creating sustained demand for reliable pipe materials.

Productivity Distribution

China occupies a leading position in the manufacturing field of longitudinal submerged arc welded pipes in the world. The companies produces pipes with outer diameters ranging from 406 mm to 1620 mm and wall thicknesses ranging from 6.35 mm to 60 mm. India has also become an important participant, and companies like Jindal SAW produced more than 900,000 tons of spiral welded pipes in 2023. Europe has maintained strong manufacturing capacity through companies such as EURO PIPE and Tenaris, while the Middle East remains the main demand center for pipeline projects.

Changes of buyer’s behavior

In 2025-2026, buyers will be given more and more priority:

- Traceability and documents: Factory test certificates (EN 10204/3.1 B) and traceability of heat number.

- Quality assurance: Third party inspection, ultrasonic inspection and radiographic inspection.

- Customization flexibility: Ability to meet the requirements and standards of specific projects.

- Sustainability: Environmental Certification and Green Production Practice.

- Supply chain reliability: On-time delivery and consistent quality across large orders.

How We Selected the Top 10 Manufacturers

Assessment Criteria

Our selection process was based on a comprehensive assessment of the following factors:

- Manufacturing Capacity: Annual production capacity, equipment capacity and technical progress.

- Compliance with standards: It has passed the Certification of API 5L, ISO 9001, ce and other international standards.

- Export experience: the experience of global market existence and serving international customers.

- Project References: Track record of major infrastructure and energy projects.

- Quality Control Systems: Implementation of advanced testing and inspection protocols.

- Technical support: engineering professional knowledge and after-sales service ability.

Top ten steel pipe manufacturers of LSAW in 2026

1. Tenaris

- Company Overview: Tenaris is a global leader in steel pipe manufacturing with a comprehensive portfolio of LSAW pipes for oil and gas, construction, and industrial applications. The company operates production facilities all over the world and pays close attention to research and development.

- Manufacturing advantages: advanced JCOE and UOE molding technologies, automated production lines and extensive quality control systems, including ultrasonic and radiographic inspection.

- Typical Markets Served: Global oil and gas industry, offshore projects, power generation, and infrastructure development.

- Standards and Certifications: API 5L PSL 1/PSL 2, ISO 9001, ISO 14001, CE, API 5 CT.

- Typical Applications: high pressure oil and gas pipelines, offshore platforms, structural piles and water delivery systems.

2. EUROPIPE GmbH

- Company Overview: EUROPIPE is a German manufacturer, specializing in the production of large-diameter LSAW pipes, which occupies an important position in the European market. The company has established partnerships with major players in the oil and gas industry and maintains advanced manufacturing facilities.

- Manufacturing advantages: precision engineering, advanced welding technologies and total quality assurance programs.

- Typical Markets Served: European infrastructure projects, North Sea offshore developments, and international pipeline projects.

- Standards and Certifications: API 5L, EN 10219, German Industrial Standard, ISO 9001.

- Typical Applications: Long-distance gas pipelines, foundation and structural application of offshore wind farm.

3. Allland Steel Pipe

- Company Overview: Hebei Allland Steel Pipe Manufacturing Co. Ltd. is a National High-Tech Enterprise headquartered in China’s “Pipe Equipment Capital” Cangzhou, Hebei Province. The company specializes in the research and development of thick-walled, large-diameter double-sided submerged arc welded pipes.

- Manufacturing Strengths: The company operates an intelligent manufacturing complex spanning 220,000 me featuring 2 JCOE production lines and 5 anti-corrosion coating lines. This enables annual outputs of 200,000 tons of premium steel pipes and 4 million me of protective coatings. Allland uses advanced JCOE molding technology to produce pipelines ranging from 406 mm to 1524 mm (16 “to 60”), and the wall thickness is as high as 60 mm.

- Typical Markets Served: Global oil and gas industry, water transmission projects, structural applications, and infrastructure development projects worldwide.

- Standards and Certifications: API 5L PSL 1/PSL 2, ISO 9001 and other international quality certifications.

- Typical Applications: High-pressure oil and gas transmission pipelines, water supply systems, offshore structure applications and large-scale infrastructure projects requiring thick-walled and large-diameter pipelines.

4. JFE Steel Corporation

- Company profile: JFE Iron and Steel Company is a Japanese iron and steel giant with rich professional knowledge in the production of longitudinal submerged arc welded pipes. In 2023, the company supplied about 1.2 million tons of steel pipes to support Japan’s natural gas pipeline modernization efforts and international export contracts.

- Manufacturing advantages: High quality steel production, advanced surface treatments and precision manufacturing technology.

- Typical Markets served: Japan’s domestic market, Asian infrastructure projects and global energy industry.

- Standards and Certifications: API 5L, JIS standards, ISO 9001, ISO 14001.

- Typical Applications: High pressure natural gas pipelines, offshore oil and gas projects and structural engineering.

5. Jindal SAW

- Company Overview: Jindal SAW is a leading Indian manufacturer with rich experience in SSAW and SSAW pipe production. In 2023, the company produced more than 900,000 tons of spiral welded pipes, which played a key role in the expansion of India’s natural gas pipeline network.

- Manufacturing advantages: Huge production capacity, cost-effective manufacturing, and strong domestic market.

- Typical Applications: Oil and natural gas pipelines, water supply systems and structural applications.

- Standards and Certifications: API 5L, ISO 9001 and API 5 CT.

- Typical Applications: oil and natural gas pipelines, water supply systems and structural applications.

6. ArcelorMittal

- Company Overview: ArcelorMittal is one of the world’s largest steel and mining companies with a significant presence in the LSAW Pipe market. The company operates a global supply chain, and maintains extensive research and development capabilities.

- Manufacturing Strengths: Diverse application range, comprehensive quality assurance programs, and advanced steelmaking technology.

- Typical Markets Served: Global oil and gas industry, construction sector, automotive industry, and infrastructure projects.

- Standards and Certifications: API 5L, ASTM, EN, ISO 9001.

- Typical Applications: High-pressure pipelines, structural steel for buildings and bridges, and industrial piping systems.

7. OMK team

- Company profile: OMK Group is a leading manufacturer in Russia, specializing in producing large-diameter LSAW pipes for large-scale infrastructure projects. The company has great production capacity and modern production facilities.

- Manufacturing advantages: Good at large-diameter pipes, cold forming and hot forming capabilities, and modern production technology.

- Typical Markets Served: Russian and CIS infrastructure projects, international pipeline developments.

- Standards and authentication: API 5L, GOST standards, ISO 9001.

- Typical Applications: Long-distance oil and gas pipelines, structural piling and large-scale infrastructure projects.

8. SSAB

- Company Profile: SSAB is a Swedish steel company, which is famous for its high strength and advanced steel products. The company has a unique position in the LSAW Pipe market due to its innovative steel grades.

- Manufacturing Strengths: Ultra-high-strength steel production, advanced surface treatment, and precision engineering.

- Typical Markets Served: High-end applications requiring superior strength, offshore projects, and specialized industrial applications.

- Standards and authentication: API 5L, EN standards, ISO 9001.

- Typical Applications: High-rise building construction, long-span bridges, and applications that require high-intensity weight reduction.

9. Hyundai Steel

- Company Overview: Hyundai Iron & Steel Co., Ltd. is a major steel producer in Korea, and has strong manufacturing capabilities in the production of longitudinal submerged arc welded pipes. The company benefits from advanced technology and manufacturing experience in South Korea.

- Manufacturing advantages: High quality production with Korean precision, advanced welding and quality control systems, and adaptability to different project requirements.

- Typical Markets Served: South Korean domestic market, Asian infrastructure projects, and global exports.

- Standards and Certifications: API 5L, ASTM standards, ISO 9001.

- Typical Applications: oil and gas pipelines, structural applications and industrial piping systems.

10. Evraz North America

- Company Overview: Evraz North America is a significant player in the North American LSAW pipe market with a large manufacturing facility enabling high-volume production. The company focuses on using local expertise to serve the north American market.

- Manufacturing Strengths: Local market focus, quick response time, and strict quality control systems.

- Typical Markets Served: North American oil and gas industry, infrastructure projects, and construction sector.

- Standards and Certifications: API 5L, ASTM standards, ISO 9001.

- Typical Applications: oil and natural gas pipelines, structural piles and water conservancy infrastructure projects.

Comparison Table: LSAW Top Manufacturers

| Manufacturer | Region | Standards | Capacity | Typical Markets |

| Tenaris | Global | API 5L, ISO 9001 | High | Oil & Gas, Offshore |

| EUROPIPE | Europe | API 5L, EN 10219 | High | European Infrastructure |

| Allland Steel | China | API 5L, ISO 9001 | 200K tons/year | Global Projects |

| JFE Steel | Japan | API 5L, JIS | 1.2M tons/year | Asian Projects |

| Jindal SAW | India | API 5L, ISO 9001 | 900K tons/year | India, Middle East |

| ArcelorMittal | Global | API 5L, ASTM, EN | Very High | Global Infrastructure |

| OMK Group | Russia | API 5L, GOST | High | CIS, International |

| SSAB | Sweden | API 5L, EN | Medium | High-Strength Applications |

| Hyundai Steel | South Korea | API 5L, ASTM | High | Asian Projects |

| Evraz NA | North America | API 5L, ASTM | High | North America |

LSAW vs SSAW vs ERW: which one should you choose?

Structural Differences

- LSAW (Longitudinal Submerged Arc Welded): Manufactured by bending steel plates into cylindrical shapes and welding along the longitudinal seam using submerged arc welding. It is characterized by a straight weld parallel to the pipeline axis, which provides excellent dimensional accuracy and high strength.

- SSAW (Spiral Submerged Arc Welded): Produced by spiral winding steel strips and welding along the spiral seam. It provides flexibility in diameter production using the same width of steel strip, but it has longer welding lengths and relatively poor geometric dimension accuracy.

- ERW (Electric Resistance Welded): Created by cold-forming steel sheets into cylindrical shapes and welding the seam with high-frequency current. Straight seams with high dimensional accuracy and smooth surface, but limited to small diameters and thin walls.

Pressure bearing Capacity

LSAW pipes is outstanding in high pressure applications because of its thick walls (up to 60 mm) and excellent welding quality. They can withstand pressures as high as 12 MPa or higher, making them ideal choice for long-distance oil and gas transportation. SSAW pipes are suitable for medium pressure applications, while ERW pipes are usually used for low and medium pressure requirements.

Cost and performance

Due to the complicated manufacturing process and higher material requirements, LSAW pipes have the highest production cost, but provide the best performance in demanding applications. SSAW pipe provides an economical and effective solution for large diameter demand with medium pressure. For small and medium diameter applications with low pressure requirements, ERW tube is the most economical choice.

Project suitability

- Choose LSAW for: High-pressure oil and gas pipelines, offshore projects, critical infrastructure, and applications requiring maximum reliability and safety.

- Choose SSAW for: water transmission, sewage treatment systems, low-pressure fluid transportation and large-diameter projects that are sensitive to cost.

- Choose ERW for: urban gas distribution, water supply networks, structural applications and projects with budgetary constraints.

How to choose reliable LSAW steel pipe manufacturer?

Authentication and detection

When selecting a manufacturer, check whether it meets the international standards, such as API 5L PSL 1/PSL 2, ISO 9001 and relevant regional standards. Ensure the manufacturer provides comprehensive mill test certificates (MTC) with chemical composition analysis, mechanical properties testing, and non-destructive testing results including ultrasonic, radiographic, and hydrostatic tests.

Match of production range

Evaluate the manufacturer’s ability to meet your specific project requirements, including diameter range (406 mm -1620 mm), wall thickness (6 mm -60 mm) and length requirements (up to 18 meters). Consider whether the LSAW pipe manufacturer can produce the required steel grades (API 5L Grade B through x 80) and whether they offer customization options for special applications.

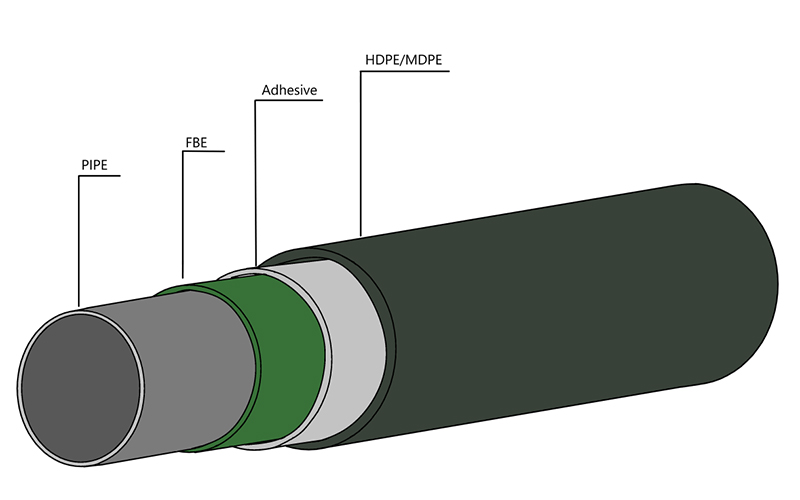

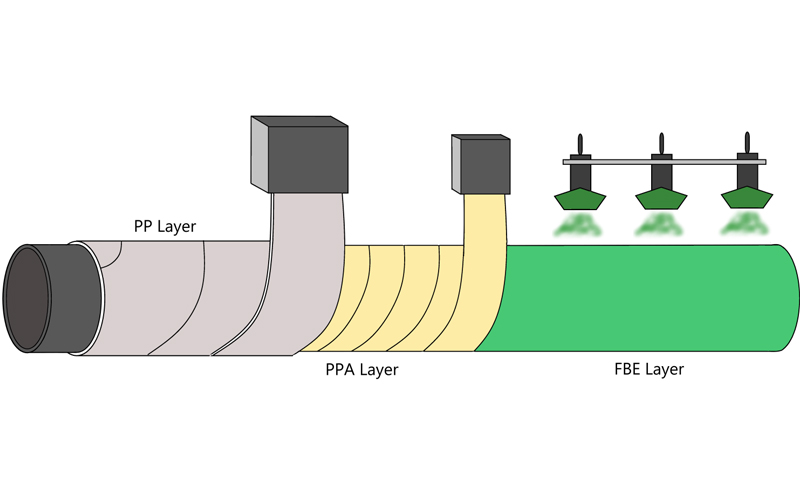

Painting and logistics capability

Evaluate the manufacturer’s ability of anti-corrosion coating, including 3 LPE, FBE, coal tar epoxy and other protective coatings. Verify their logistics network and ability to handle large-volume shipments, including packaging standards, transportation methods, and delivery timelines. Make sure that they have experience in handling international transport and customs documents.

Communication and Documentation

Choose manufacturers with responsive technical support teams that can provide engineering consulting, project documents and after-sales service. Find companies that provide comprehensive documents, including material certificates, inspection reports and traceability records. Evaluate their ability to communicate effectively in the language and time zone you like.

Frequently Asked Questions

Q 1: What diameter range can LSAW pipes cover?

A 1: LSAW pipes typically range from 406 mm to 1620 mm (16 “to 64”) in diameter, with some manufacturers capable of producing up to 1820 mm. The specific range depends on the manufacturer’s equipment capabilities.

Q 2: Is LSAW suitable for submarine pipelines?

A 2: Yes, LSAW pipes is an ideal choice for offshore pipelines, because of its high strength and good welding quality, and it can withstand harsh marine environments. They are usually used in underwater and top applications in offshore oil and gas projects.

Q 3: What is the typical lead time for production?

A 3: According to the order quantity, specifications and the manufacturer’s capacity, the production lead times is usually 30 to 60 days. Customized orders or large orders may take longer to deliver. The goal of most manufacturers is to deliver the standard products within 30 days.

Q 4: Can a tube meet multiple standards?

A 4: Yes, LSAW pipes produced by many manufacturers meet several international standards at the same time, such as API 5L, ASTM A 252 and EN 10219. This allows for greater flexibility in global project applications.

Conclusion

Driven by global infrastructure investment, energy security plan and pipeline modernization project, LSAW steel pipe market is expected to continue to grow in 2026. With the development of market dynamics, buyers are paying more and more attention to quality assurance, traceability and reliability of manufacturers, not just price.

Stricter compliance requirements and higher document standards means that manufacturers with strong quality control systems and international certifications will have a competitive advantage. Long-term partnerships and supply chain stability are becoming more important than short-term cost savings, especially for key infrastructure projects that are critical to safety and reliability.For buyers sailing in the market in 2026, focusing on manufacturers with good records, comprehensive technical support and the ability to meet the requirements of specific project will be key to successful procurement. The top manufacturers highlighted in this guide represent the industry leaders who are well-positioned to meet the evolving demands of the global LSAW pipe market.

Share:

Get Your Custom Steel Pipe Quote Today!

Provide us with your project details (like application, specifications, quantity). Our experienced team will respond with a tailored solution and competitive quote within 24 business hours.

Related Articles

ASTM A53 vs. API 5L: A Guide to Selection and Application

Introduction:Technology differences determine success or failure, and selection needs to be “precise”

Steel Density Analysis: Core Differences between Mild and Medium Carbon Steels and Industrial Applications

3LPE coated steel pipe: a solid barrier in the field of industrial corrosion protection

3LPP coated pipe: anti-corrosion guard in high temperature and high pressure environment

FBE steel pipe: the technological armor of the steel defense line

HOT TAGS

latest posts

- 3LPP coated pipe: anti-corrosion guard in high temperature and high pressure environment

- ASTM A53 LSAW Steel Pipe Selection Guide for Oil and Gas Transportation Pipelines

- API 5L LSAW Pipe: A Deep Dive into PSL1 vs. PSL2

- Steel Pipe Sizing Errors? DN vs. OD Explained for Buyers

- NDT for Pipe Welds: X-ray vs. Ultrasonic Testing